Financial

News

AlarmForce reports Q1 2017 financial results

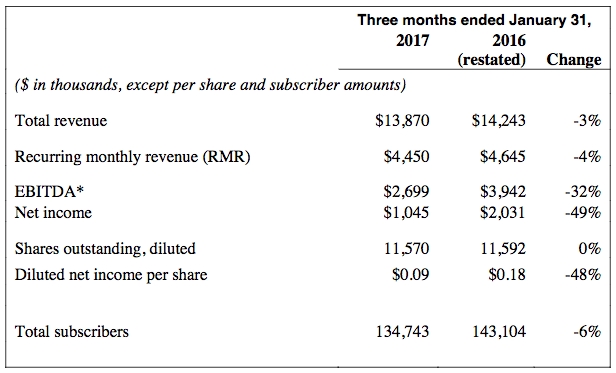

Total revenues for AlarmForce’s first three months of 2017 were $13.9 million vs. $14.2 million over the same period in 2016, the company has reported, which is also a decrease of 3 per cent (2 per cent in constant currency).

March 14, 2017 By SP&T Staff

Recurring Monthly Revenue (RMR) remained flat at $4.45 million at the end of Q1 2017 from $4.45 million at the end of fiscal 2016 (an increase of 1 per cent in constant currency). Gross profit totaled $9.1 million compared to $9.9 million or a decline of 8 per cent over the same period in 2016. Net income decreased year over year from the same period of 2016 to $1.045 million from $2.03 million.

These results were driven by a lower average subscriber base, according to AlarmForce, and the incurrence of one‐time costs related to the consumer contract and employment classification issues totalling $0.9 million. Diluted earnings per share decreased to $0.09 compared to $0.18 in the same period of 2016. Adjusted earnings per share would be $0.15.

“At the end of the first quarter, we completed the review process and adjoining restatements fulfilling our filing requirements,” said Graham Badun, president and CEO of AlarmForce Industries Inc. “Our ongoing efforts to improve the underlying quality of our subscriber base through a focus on the Canadian markets has started to yield encouraging results. This can be seen in our Canadian alarm RMR attrition rate which is less than 5 per cent and the 17.7 per cent increase in average revenue per new Canadian alarm user versus the same period last year. We can now collectively focus our entire team on continuing to improve operations and increasing our subscription base through a number of strategic initiatives including marketing, product innovations and new partnerships.”

In the first three months of the year the company returned $0.5 million to shareholders through dividends paid.

Print this page

Advertisement

- Leviton launches 2017 Five Star Dealer Program

- Let there be light: No perfect solution for under-lit surveillance, but technology constantly improving