Headlines

News

IHS Markit: convergence of ICT and video surveillance technologies accelerating

According to an IHS Markit study by Monica Wang, APAC research leader, safe city and video surveillance, information communications technology (ICT) infrastructure is becoming an increasingly important part of project implementation as more large-scale video surveillance projects are being deployed.

June 4, 2018 By SP&T Staff

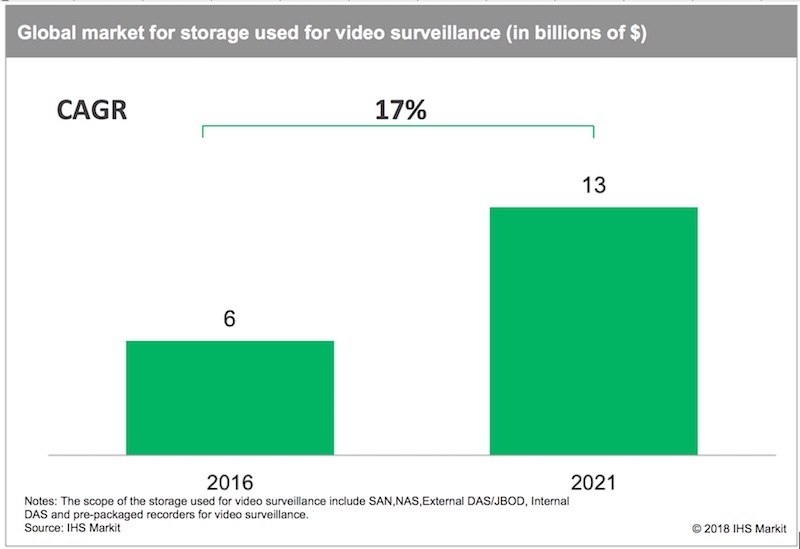

Global revenue from storage equipment, a key element of ICT infrastructure, has been growing rapidly. According to the latest “Enterprise and IP storage used for video surveillance report” by IHS Markit, global revenue from storage used for video surveillance is forecast to grow at a CAGR of 17 per cent, from $6 billion in 2016 to $13 billion in 2021.

Dell EMC, Huawei, NEC, Motorola and other traditional ICT vendors have entered the video surveillance market, either with solutions based on their ICT strengths or by acquiring video surveillance companies.

At the same time, traditional video surveillance vendors have started to offer ICT products to complement their solutions. For example, Hikvision announced its AI Cloud concept at CPSE 2017, and Dahua and NetPosa showcased their video-structuring servers.

Driving forces

New transformational technologies are driving the convergence trend, the study reports.

For example, deep-learning-based video surveillance analytics promise to generate more metadata that was impossible to generate in the past. Evolving IoT applications with dynamic connected sensors demand faster and more powerful computing platforms. Cloud architectures are being adopted to enable easier data sharing across larger, more complex networks.

Implications

One major implication of this convergence is that traditional video surveillance business models are likely to be influenced by concepts from the ICT industry, says IHS Markit.

For example, an open hardware platform with a related software ecosystem is a typical ICT concept. Huawei is now introducing this concept to the video surveillance industry. In March, the company announced its software-defined camera (SDC) concept, claiming it will enable diversified video analytics algorithms, developed by the independent software vendors (ISV) ecosystem, to run on one camera.

According to Huawei, SDC will decouple the software from its hardware, based on its open operating system, open integration framework and unified algorithm management platform on the cloud.

The IHS Markit report adds that video surveillance as a service (VSaaS) or video analytics as a service (VAaaS) are two more ongoing examples of ICT changing traditional video surveillance business models. These two technologies offer vendors the possibility of generating regularly recurring revenue, a concept commonly used for ICT.

The bottom line

The video surveillance market is becoming increasingly intertwined with other industries, the study concludes.

ICT and telecom suppliers are now competing for business where there were once dedicated security distributors and integrators. Advanced ICT infrastructure integrating IoT devices across the network has replaced traditional analog cabling between devices.

Overall, “companies embracing emerging technologies and developing leading infrastructure and network skill sets will be well-placed to win business, as ICT infrastructure and concepts play an increasingly important role in video surveillance,” the report says.

Print this page